Pricing is one of the most essential components of an insurance company. It is the process by which an insurance company sets up the premium that needs to be charged to the policyholder by considering various risk factors such as age, mortality, gender, location, etc. These are some of many factors used by the insurance sector for calculating premiums and will vary with the nature of the product being priced. It is one of the tasks of an Actuary to perform pricing in a General Insurance company.

To calculate the premium amount, a very important concept is used called the “Generalized Linear Models” which is used by the Pricing team for a really precise premium calculation since it can accommodate many factors. As more factors are added, more accuracy will be there in premium calculation but one should remember that every additional factor should have a significant effect in terms of explaining the variability of the dependent variable, which in this case will be the premium to be charged. The significant effect to each added factor is important because each additional factor is associated with a heavy costs in terms of modeling time and analysis which the insurance company has to bear.

Presently, we are living in a world of powerful computers that are designed to perform One-way Analysis, Two-way Analysis, Three-way Analysis, and even more to find associations between various factors. But even after so much computational power and analysis, this is not the final premium that is charged. The final premium that is charged can be way lower than what is calculated by the GLM.

REASON?

Cut-Throat Competition

In this highly competitive world, if one has to survive in the market it is important to keep the price of products competitive to what other companies are charging. To do so, the premium is charged lower than the actual calculated one which leads to underwriting losses also and that is why, pricing in General Insurance requires an Actuary to focus on each and every aspect of the product being made.

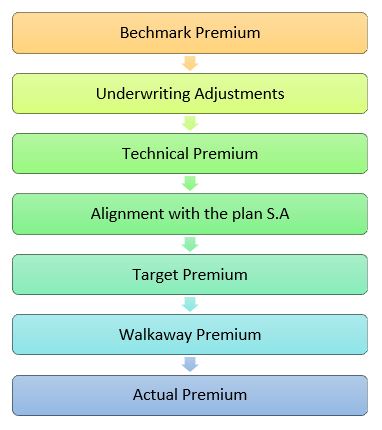

The company goes through a lot of decision-making before reaching the final premium and in each step premium decreases. The steps are as follows –

1) BENCHMARK PREMIUM – This premium forms the basis for the calculation of the actual premium. The benchmark premium constitutes of mainly three things

the profit margin for the company to cover the risk,- expected claim cost and

- cla

im related expenses

2) UNDERWRITING ADJUSTMENTS – The next step involves making underwriting adjustments in the benchmark premium. These adjustments differ for different groups of homogeneous

3) TECHNICAL PREMIUM – After doing the underwriting adjustments, the actuary calculates the technical premium. This premium is calculated considering the past experiences of the claim.

4) PREMIUM ALIGNMENT – The next step is to align the premium with the sum assured in such a way that they remain parallel at all levels of the sum assured. This step helps the agents and insured to understand the different premium rates.

5) TARGET PREMIUM – Due to fierce competition in the insurance sector, the actuary lowers the premium by lowering the overall premium. The target premium is such that it constitutes mostly the claim cost.

6) WALKAWAY PREMIUM – Due to the motive of sustaining in the market, the company still doesn’t charge the target premium. So, a walkaway premium is decided by lowering the target premium is leading to some risk of underwriting loss.

7) ACTUAL PREMIUM – Due to competition, the underwriter still wants to charge less premium. A dispute arises between the actuary and the underwriter. The CEO comes in to solve this dispute and the actual premium is decided which is even less than the walkaway premium! This is done with the motive of increasing sales but this leads to underwriting losses,

So, How does a General Insurance company earn?

Insurance companies earn in two ways.

- Underwriting Income

- Investment Income

The underwriting income is nothing more than the difference between the premium received and the expenses and claim amount paid. The net difference that remains is underwriting income for the company

On the other hand, every insurance company invests part of the collected premium in different profitable businesses. It also invests in share market, mutual funds and other financial instruments. The profit or interest generated on these investments is the investment income for the company.

Final Thoughts

Almost every insurance company offsets the underwriting losses through investment income and investment income can form a substantial portion of the profit and loss account.

Comments 2

Related Posts

Surety Bond: How Do They Actually Work & Actuarial ConsiderationsBlog 84: BRK.B by Xavier Lo, FIA, FRM, MBABlog 83: VOO by Xavier Lo, FIA, FRM, MBABlog 82: 0005.HK HSBC by Xavier Lo, FIA, FRM, MBA

Pingback: Homepage

Its really interesting…kindly may i join your club