What Is Unearned Premium?

Unearned premium is the premium which is corresponding to the time period remaining on an insurance policy. These are proportionate to the unexpired portion of the insurance premium paid and appear as a liability on the insurer’s balance sheet since they would be paid back upon cancellation of the policy. This way, at the end of the first year of a fully prepaid five-year insurance policy with insurance premiums of INR 2,000 per year, the insurer has earned a premium of INR 2,000 and has an unearned premium of INR 8,000. The Unearned premium reserve (UPR) is calculated in the same manner. It helps in various diagnostics during the calculation of Incurred But not Reported, IBNR Reserves and as well is used in financials for the company

Unearned Premium Explained

Unearned premiums are portions of premiums collected in advance by insurance companies and subject to return if a client ends coverage before the term covered by the premium is complete. An unearned premium may be returned when an insured item is declared a total loss and coverage is no longer required, or when the insurance provider cancels the coverage.

For example, consider a client who paid an auto insurance premium one year in advance and experienced the destruction of his vehicle four months into the coverage period. The insurance company keeps one-third of the annual premium for coverage provided and returns the other two-thirds as unearned premiums.

Provisions in the insurance contract govern the terms for unearned premiums. The provisions must follow regulations related to the area where the coverage is offered. A specific formula for calculating the amount of the unearned premium may be required.

Earned Premiums Explains

Earned premiums represent the portion of collected premiums that insurance companies recognize as revenue for coverage provided during a specific period. This concept reflects the income earned by the insurer for the risks covered during that time frame. As insurance coverage is provided, premiums collected in advance transition from unearned to earned status, aligning the company’s revenue with the period of risk coverage.

For instance, if a client has paid an annual auto insurance premium in advance, and three months into the coverage period, the insurance company will have earned a quarter of the annual premium as earned premium. This is because the insurer has provided coverage for three months out of the twelve-month policy term. The rest of the premium remains as unearned until more time passes or the coverage period ends.

The calculation and recognition of earned premiums are crucial for accurate financial reporting and management in insurance companies. These practices ensure that revenue is matched with the period in which the service, i.e., risk coverage, is actually provided. Methods for determining earned premiums include the pro-rata and exposure methods, which consider the passage of time and the degree of risk covered, respectively. The specific approach and calculations are governed by accounting standards and regulations pertinent to the insurance industry in the relevant jurisdiction.

Reasons for Not Returning Unearned Premium

The premium that a policyholder pays for an insurance contract is not immediately recognized as earnings by the insurer. In certain circumstances, an insurance company may not have to issue a refund for unearned premium.

For example, if the policyholder has falsified information on the application for obtaining insurance coverage, the provider may not be required to refund any part of the earned or unearned premiums collected. Policies typically outline the conditions that must be met when applying for and receiving the unearned portion of a premium.

Insurance providers may not have to return a portion of unearned premium when a policyholder terminates the coverage for no given reason, or for reasons such as securing a similar policy with a different provider. It is best for the policyholder to wait until the coverage period of the last paid premium is closed before switching insurance companies.

However, if the insured can prove the provider did not honor the terms and conditions described in the provisions of the policy, any unused portion of the premium should be refunded.

Unearned Premium (UPR) & Earned Premiums (EP) different calculation methods

Pro Rata Method

Overview

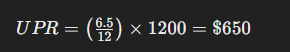

The Pro Rata method calculates UPR by determining the portion of the premium that corresponds to the unexpired period of the policy coverage.

Example

If an insurer issues a 12-month policy with a total premium of $1,200 on July 1, and the UPR is being calculated on December 31, the unexpired portion of the policy is 6 months. The UPR would be calculated as follows:

UPR = 6/12×1200=$600

EP = $1200 – $600 = $600

24th Method

Overview

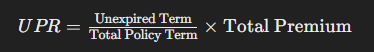

The 24th method is a more refined approach, considering each month of the policy term as having an equal part of the premium. It assumes that policies are evenly distributed throughout the month and is calculated as follows:

Example

Using the same policy with a $1,200 premium for 12 months, if we’re calculating UPR at the end of December (assuming the policy started on July 1), the calculation under the 24th method would be slightly different:

For six full months remaining:

UPR =(6.5/12)×1200=$650

EP = $1200 – $650 = $550

The addition of the half-month accounts for the midpoint calculation inherent in the 24th method.

3. Exposure Method

Overview

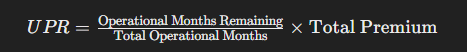

The Exposure Method calculates UPR based on the actual exposure the insurance company has during the policy period. This method is particularly useful for policies where risk varies significantly over the policy period.

Example

Consider a policy covering seasonal business operations with a total premium of $1,200. If the business is operational only 8 months of the year, and the UPR calculation is at the end of December, with the business season starting in April:

Assuming the risk is negligible outside the operational months, the UPR could be calculated based on the operational months remaining. If 4 months of operation are left:

UPR = 4/8×1200=$600

EP = $1200 – $600 = $600

Each of these methods has its advantages and applicability depending on the type of insurance product, the distribution of risk over the policy period, and regulatory or accounting requirements. Selecting the appropriate method is crucial for accurate financial reporting and effective risk management.

An Example of Unearned Premium calculation

Because canceling a policy may mean issuing a refund, unearned premiums appear as liabilities on an insurance company’s balance sheet.

For example, an insurance company receives $600 on January 27 for coverage from February 1 to July 31, but as of January 31, the $600 has not been earned. The insurance company reports $600 in its cash account and reports $600 as a current liability in its unearned premium revenue account. As the company earns the premium, the provider moves the amount earned from the liability account to a revenue account on its income statement.

KEY TAKEAWAYS

- An unearned premium is the premium corresponding to the period remaining on an insurance policy.

- Provisions in the insurance contract govern the terms for unearned premiums.

- In certain circumstances, an insurance company may not have to issue a refund for unearned premium.

The Difference Between Unearned Premium and Earned Premium

An unearned premium on an insurance policy can be contrasted with an earned premium. An earned premium is a pro-rated amount of paid-in-advance premiums that has been “earned” and now belongs to the insurer. The amount of the earned premium equates to the sum of the total premiums collected by an insurance company over a period of time.

In other words, the earned premium is the portion of an insurance premium that was paid for a portion of time in which the insurance policy was in effect, but has now passed and expired. Since the insurance company covered the risk during that time, it can now consider the associated premium payments it took from the insured as “earned.”

Earned premium is the portion of an insurance premium that has been “earned” by the insurance company, reflecting coverage that has already been provided. Actuaries calculate this figure to assess the insurer’s earned revenue from policies in force, considering the risk exposure over the coverage period. This metric is crucial for financial stability and pricing future policies accurately.

Unearned premium reserves are liabilities on an insurer’s balance sheet, representing premiums received but not yet earned because the coverage has not been provided. Actuaries calculate these reserves to ensure that the insurer can refund premiums if policies are canceled or adjusted

Actuaries use several methods to calculate earned premiums, most commonly the pro-rata and exposure methods. The pro-rata method allocates premium earnings evenly over the policy period, while the exposure method adjusts earnings based on the actual exposure to risk over time. These calculations are integral to matching revenues with the period risks are covered and for ensuring accurate financial reporting.

Earned premium represents the portion of the premium that corresponds to the coverage already provided, while unearned premium represents the portion of the premium for coverage yet to be provided.

There are various methods to calculate Unearned premiums that can further be used to calculate Earned Premiums. These are described in this particular article including but not limited to: – Pro Rata Method – 1/24th Method (Monthly) – 1/8th Method (Quarterly) – Exposure Method (Monthly)

Actuaries consider unearned premium reserves when pricing insurance products to ensure that premiums are sufficient not only to cover expected claims but also to maintain adequate reserves.

Learn Excel or Python/R for Data Science

Best Python & R in Data Science course

Machine Learning A-Z™: Hands-On Python & R In Data Science

Best Excel course

Microsoft Excel – Excel from Beginner to Advanced.

Source: Investopedia