If you haven’t read our previous articles on Insurtech, please give it a go on The Actuarial Club. We highly recommend you to read these articles in addition to this one to get a better understanding of Insurtech in India as well globally.

How Global Insurtech arrange fundings?

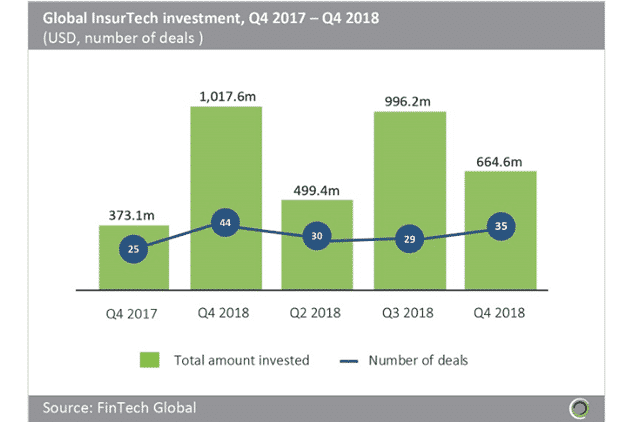

- Global Insurtech Investment has arranged fundings between 2017 and 2018.

- Insurtech companies globally raised more than $8.5bn between 2014 and 2018, with 599 deals completed during the period.

- The number of transactions peaked at 151 in 2016, with over $1.4bn raised by Insurtech companies that year. Oscar, a New York-based health insurance provider, raised $400m of private equity funding at a $2.7bn valuation. This round, led by Fidelity Investments, was the largest Insurtech deal of 2016 and is the third-largest Insurtech deal to date.

- Investment almost doubled from over $1.6bn in 2017 to almost $3.2bn last year, while deal activity dipped slightly from 141 transactions to 138 during the period. Armour, a Bermuda-based P&C insurance business, raised $500m from Aquiline Capital Partners in Q1 2018 to create a new reinsurance group. This was the largest Insurtech deal of 2018.

Insurtech Funding in the world:

- Global Insurtech investment reached $664.6m in Q4 2018 which is 78% higher than the capital raised in Q4 2017.

- Prima Assicurazioni, a Milan-based online insurance company, raised $115m from investors including Goldman Sachs Private Capital Investing and Blackstone Group in October 2018. This was the largest Insurtech deal in Europe last quarter. Prima intends to use the funds to invest in new technologies and expand its marketing and sales teams.

- Insurtech funding surged in Q1 2018 with over $1bn raised across 44 deals. However, with previously mentioned Armour raising $500m of this investment.

- Q3 2018 was also very strong with Insurtech companies raising $996.2m across 29 transactions. Aforementioned health insurance provider Oscar raised $375m from Alphabet in the largest deal of the quarter. The funding will allow Oscar to increase its headcount of engineers and data scientists.

Insurtech Funding In India:

- ‘POLICYBAZAAR’ (a Gurugram-based company) is backed by SoftBank, Tiger Global Management, PremjiInvest, Temasek Holdings, and IDG Ventures India among others. In June, PolicyBazaar became a Unicorn when parent company ETechAces Marketing & Consulting Pvt Ltd raised $200 million.

- Owned by Digit Infoworks, Digit Insurance has raised $94 million from investors, including Fairfax Financial (insurers of Canada) which holds close to 35 percent stake in Digit Insurance as of May this year.

- Founded in 2013 by Varun Dua and Devendra Rane, Coverfox is a Mumbai-based startup that has raised around $40 million. The investors including IFC, Transamerica Ventures, SAIF Partners, Accel, NR Narayana Murthy, and Catamaran Ventures being the fundraisers.

- Backed by investors such as Amazon, Accel, SAIF Partners, Catamaran Ventures, NR Narayana Murthy, and Kris Gopalakrishnan among others, the insurance startup Acko General Insurance launched by Varun Dua raised eyebrows in May 2017 for raising $30 million in seed investments even before it started operations. In May 2018, it raised another $12 million.

For more such articles click here.

This article was written by Anmol Kaur.

This article was published by Kautilya Sharma.