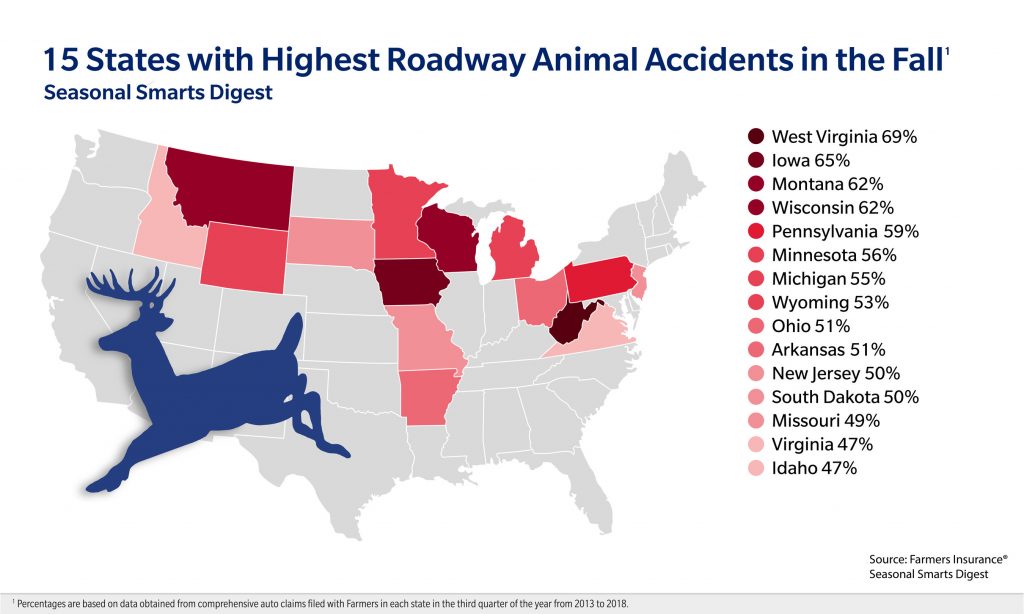

PRNewswire/ — Autumn marks the start of migration season for many species, which can lead to more encounters between drivers and animals on roadways. Farmers Insurance® reveals 36% of Comprehensive auto claims filed with Farmers® due to accidents with animals occur between September and November, according to the previous five years’ worth of Farmers claims data1.

The Fall 2019 Seasonal Smarts Digest encourages drivers to keep an eye out for unexpected wildlife when they hit the roads this fall. It’s also helpful for drivers to understand the type of coverage needed in the event of an accident with an animal. Comprehensive insurance covers damage to your car not caused by a collision. This may include damage involving animals of all types and sizes.

“If you find yourself facing a potential accident with a deer or other animal, do your best to stay the course,” said Jim Taylor, head of claims customer experience for Farmers Insurance. “It may sound counterintuitive but staying the course may be safer for you and other vehicles on the road than swerving at high speeds in an attempt to avoid the animal.”

This may surprise the 66% of surveyed drivers who believe that swerving to avoid a deer is the best way to minimize damages2. But swerving at high speeds increases the potential of losing control, causing a rollover or colliding with another vehicle3. In most situations, it’s safer for drivers to maintain control of their vehicle and proceed with as much caution as possible.

Drivers can’t prevent animals from crossing the road, but they can exercise caution to stay safer during unexpected wildlife encounters. In particular, Taylor suggests drivers heed the following suggestions:

- Use your high beams: Wildlife is often most active at dusk and dawn, according to the Colorado Parks Department. If appropriate, while driving at night (when there is no fog present, or oncoming traffic) use your high beams to increase visibility and spot animals more easily. Or, stick to daylight hours if you can, to help reduce your risk.

- Heed warning signs: States and cities often place wildlife crossing signs near areas with heavy animal traffic for good reason – keep an eye out for signs, and of course, animals on the move.

- Stick to the middle lane: If you’re on a multi-lane road, staying in the middle lane may give you more time to spot an animal that may be crossing ahead of you.

- Know what to do if an accident occurs: If you hit an animal, pull over and call local law enforcement. They can direct you on what actions to take. Make sure you stay away from the animal since they may only be stunned and might panic if you come close, causing additional harm to you or your vehicle.

- Get home safely: If you hit an animal, don’t assume your car is safe to drive. Look for any leaks, loose parts, broken lights and tire damage. If you spot issues or if your vehicle seems unsafe, have the car towed.

About Farmers Insurance

“Farmers Insurance®” and “Farmers®” are tradenames for a group of insurers providing insurance for automobiles, homes and small businesses and a wide range of other insurance and financial services and products. Farmers Insurance is proud to serve more than 5 million households with over 15 million individual policies nationally, through the efforts of more than 45,000 exclusive and independent agents and approximately 20,000 employees. Farmers Insurance Exchange®, the largest of the three primary insurers that make up Farmers Insurance, is recognized as one of the largest U.S. companies on the 2019 Fortune 500 list. For more information about Farmers Insurance, visit Farmers.com, Twitter and Instagram, @WeAreFarmers, or Facebook.com/FarmersInsurance.

1 Based on historical data from auto claims filed with Farmers nationally between 2013 and 2018.

2 ORC International’s CARAVAN®: This digest presents the findings of a survey conducted among a sample of 1,002 adults comprising 500 men and 502 women 18 years of age and older. ORC International’s CARAVAN® conducts an online omnibus study twice a week among a demographically representative U.S. sample of 1,000 adults 18 years of age and older. This survey was live on August 2-5, 2018.

3 Insurance Information Institute: https://www.iii.org/article/avoid-a-deer-car-collision.

https://www.iii.org/article/avoid-a-deer-car-collision.