Surety bonds are a type of financial guarantee that protects against potential losses or breaches of contract. They are commonly used in construction, government contracting, and other industries where performance …

Defining Microinsurance | An untapped market

IRDA micro-insurance Regulations, 2005 defines microinsurance as a general or life insurance policy with a sum assured of Rs 50,000 or less. In other words, micro-insurance aims to provide financial …

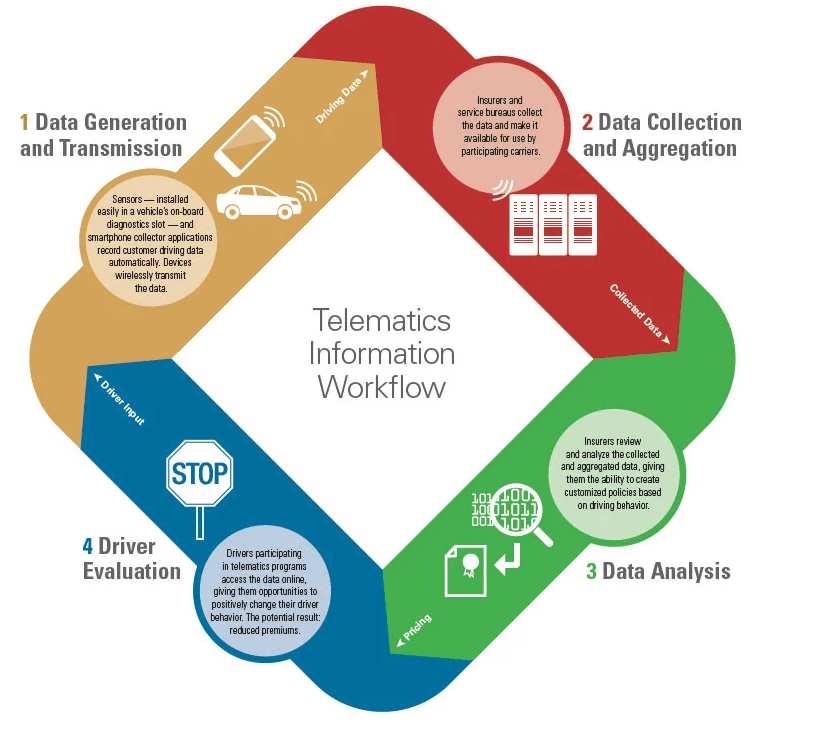

TELEMATICS IN INSURANCE

Telematics is the combination of words, “telecommunications” & “informatics” . When this term is used in Insurance, it is called “Telematics Insurance”. Telematics in insurance works by fitting your car with …

Group of Actuaries and Investment Officers to study index-linked products in India

The group will examine the need for index-linked products in India with reference to availability of various indexes and how it will better serve the needs and interests of customers relative to traditional savings products.

Insurtech Part 6: Challenges faced by Insurtech startups

If you haven’t read our previous articles on Insurtech, please give it a go on The Actuarial Club. We highly recommend you to read these articles in addition to this …

Insurtech Part 5: How Insurtech arrange funding

If you haven’t read our previous articles on Insurtech, please give it a go on The Actuarial Club. We highly recommend you to read these articles in addition to this …

Insurtech Part 4: Benefits of Insurtech to Insurance Companies

Many companies are already benefiting from the advent of Insurtech. As they have transformed themselves digitally to offer convenience, security, choice, and comparison to their modern customers, it becomes important …

Insurtech Part 3: Emerging Insurtech models in India

If you haven’t read our previous two articles on Part 1: What is Insurtech and Reason of Growth and Part 2: How Insurtech is reshaping the global insurance market, please …

Application and Challenges of Machine Learning In Insurance Sector

Data has always played the role of the backbone in the insurance sector. Nowadays the rate of increase in data is greater than the population growth itself. Big companies and …

Insurtech Part 2: How Insurtech is reshaping the global insurance market

If you haven’t read our first article; Insurtech Part 1 – What is Insurtech and Reason of Growth. We highly recommend to read that first before reading part 2; How …

Insurtech Part 1 – What is Insurtech and Reason of Growth

In this article, as Insurtech Part 1, the author is going to give you an Introduction of What is Insurtech? & Why it has seen an explosive growth? The case studies will follow soon.

AXA XL Develops Insurance for Hoyos to Launch World’s Most Secure Digital “Hot” Wallet

AXA XL, the Property & Casualty and Specialty Risk division of AXA, has developed an innovative insurance solution for Hoyos Integrity Corporation (Hoyos) to launch the world’s most secure digital “Hot” wallet.

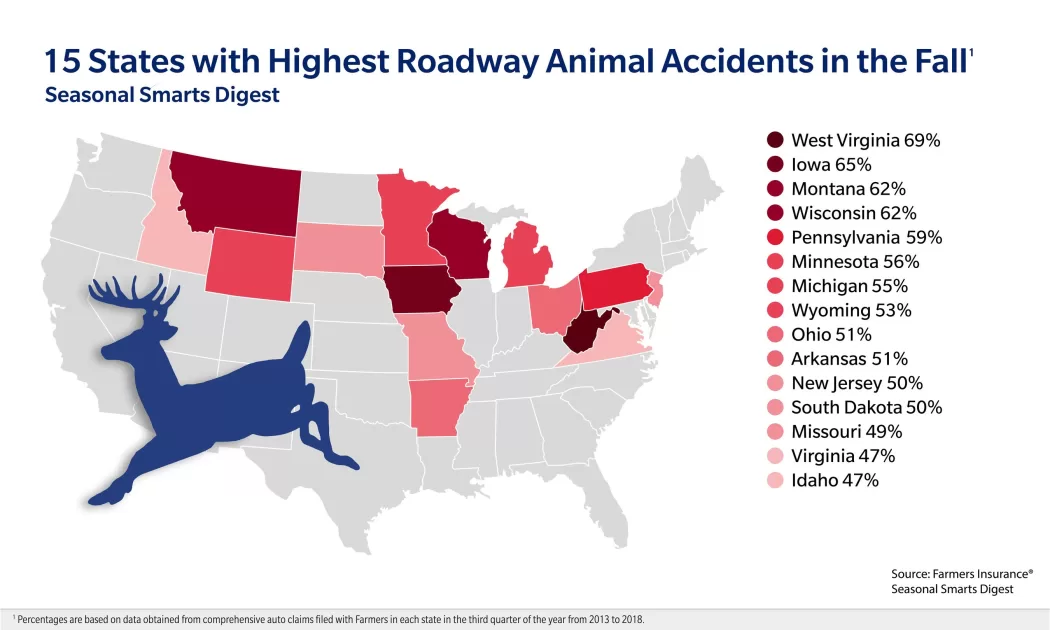

Farmers Insurance® Finds Accidents with Animals Spike in the Fall Months

PRNewswire/ — Autumn marks the start of migration season for many species, which can lead to more encounters between drivers and animals on roadways. Farmers Insurance® reveals 36% of Comprehensive auto …

Policygenius announces the opening of second headquarters in Durham, North Carolina

the nation’s leading online insurance marketplace, announced the opening of a second headquarters in Durham, North Carolina. The first headquarters is in the Flatiron District, the largest tech hub in New York City.

Indian Insurance Sector – At the Crossroad of Development

“Insurers need to become catalysts for innovation and government need to spread awareness across each corner of the whole country in order to drive growth in Indian insurance sector” Even …