Data has always played the role of the backbone in the insurance sector. Nowadays the rate of increase in data is greater than the population growth itself. Big companies and startups are looking forward to investing in data analytics. But human effort can’t compile the size of data produced daily by us.

Such data is useless until AI or Machine learning are introduced.

AI and Machine learning help us to make decisions. Every organization is a factory of making decisions. For financial institutes that number is extremely high. Every day they make thousands of decisions. What AI does is it takes the data and it creates an algorithm that will generate predictions at different insights. This enables people to make objectives and more evidence-based decision making.

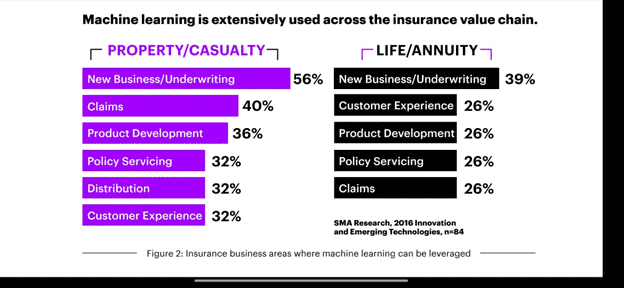

Slowly and steadily the insurance sector is also welcoming AI and ML. Major insurance companies use only 15-20% of traditional data available to design a product. This way they not only fail to unlock values from their structured data but also ignore the valuable insights hidden in their unstructured data. Machine learning can be used to mine all the data structured, semi-structured and unstructured for business insights. This can help them understand risk, customer behaviour and claims with higher accuracy.

Impacts on the Industry

Customer Service and Insurance Advice: – Machine learning will change customer interaction before and after-sales. According to a recent survey, more than 70% of customers prefer to receive computer-generated insurance advice. AI is used to introduce chatbots for claim and pricing related to customer interaction. Lemonade, an insurance startup, uses AI chatbots to process claims more quickly and provide the customer with fast payouts. This is one of the fastest-growing companies in the insurance space raising 800 million USD already. They are also planning to expand in Europe.

Personalization: – Customers prefer a customized product that meets their individual requirements. Using analytics and machine learning companies have the option to improve their product for consumers and increase their marketing ROI.

Fraud detection and prevention: – Fraud claims are the termite for the insurance company. Nearly 1 out of every 4 claims involve a claim abuse. That’s about 6 billion USD of insurance fraud in India. If companies develop some algorithms to reduce these frauds effectively, this will positively affect the cash flows. Some organizations are already using analytics and machine learning to identify claims that are more likely to be fraudulent than others. This is also very quick and efficient as compared to human capabilities.

Risk management: – Insurer works with machine learning to decide premium and losses for their product. Telematics is the integration of telecommunication and IT to operate remote devices over a network. Auto-insurers are using telematics, mobile apps and Snapshot devices, for collecting 14 billion miles of driving data of every customer to understand their lifestyle.

For example – Customer’s vehicle that’s mostly in the parking lot has less risk associated with it than on a 2 lane highway. Progressive (auto-insurer) offers “most drivers” an auto insurance discount averaging 130 USD after six months of use.

Challenges while adopting Machine Learning for Insurance Companies

Training requirement: – AI, ML models must be trained in the domains providing a huge volume of data like documents or transactions to cover all possible scenarios which require a separate training system.

Right data source: – The quality of data used to train predictive models is equally important as the quantity. The datasets need to be representative and balanced so that they can give a better picture and avoid bias. This is important to train predictive models. Generally, insurers struggle to provide relevant data for training AI models.

Difficulty in predicting returns: – It’s not very easy to predict improvements that machine learning can bring to a project. For example, it’s not easy to plan or budget a project using machine learning as the funding needs may vary during the project based on the findings. Therefore, it is almost impossible to predict the return on investment. This makes it hard to get everyone on board the concept and invest in it.

Data Security: – The huge amount of data used for machine learning algorithms has created an additional security risk for insurance companies. With an increase in collected data and connectivity among applications, there is a risk of data leaks and security breaches. A security incident could lead to personal information falling into the wrong hands. This creates fear in the minds of insurers.

Also Read-Insights: Modelling and Management of Cyber Risk

Developing a machine learning model to replace humans will require eternity and still the efficiency will not match as humans. Machine learning can analyze data using trends which further can be cross-examined by humans to find out of the box scenarios.

About the Author:

I’m Pranav Sharma, pursuing B.Sc Mathematical sciences(second year) from Delhi University. I have cleared CT3 and currently preparing for Exam IFM.